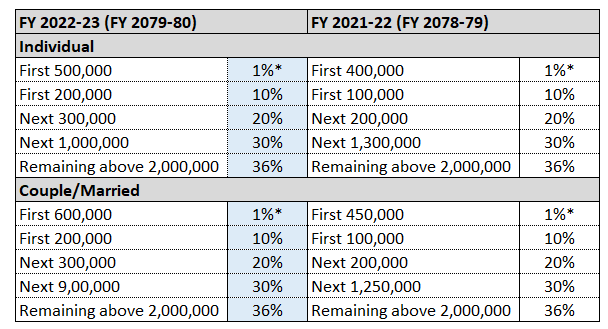

Finance Act, 2079 has given considerable relief in Personal Income Tax. It has amended the tax slabs and also increased few deductions for the FY 2079/80 (2022/23) as compared to FY 2078/79 (2021-22). Excel Sheet for Salary TDS for FY 2079-80 and other relevant points have been presented below:

*Tax payer registered as sole proprietorship or on pension income or on income from contribution based pension fund shall not attract social security tax (i.e. 1%). Additionally, if the taxpayer is depositing amount in the Social Security Fund (SSF) then for those taxpayer Social Security Tax is not applicable.

**A widow/widower who has to look after the dependent is treated as Couple. [Section-50(3) of Income Tax Act, 2058]

To check the TDS liability or calculate the annual TDS liability of your organization, you can download attached Excel sheet for salary TDS.

YouTube tutorial is also provided for easy understanding.

Exemption for Resident Natural Persons

With increase in exemption limit of life insurance to 40,000 from these year individual (i.e. Resident Natural Persons) will get following benefits.

- Resident Disabled/Incapacitated person shall get an additional 50% of Exemption Limit (i.e. 50% of Rs. 600,000 in case of Couple & 50% of Rs. 500,000 in case of Individual).

- Individual having Life Insurance Policy shall get an additional exemption from the Taxable Income to the extent of Rs. 40,000 (earlier Rs. 25,000) or Premium Amount, whichever is lower.

- Individual having Health Insurance Policy shall get an additional exemption from the Taxable Income to the extent of Rs. 20,000 or Premium Amount, whichever is lower.

- Annual Remote Area Allowance up to Rs. 50,000 (depending upon Remote Area Category) is exempted from tax.

- Individual depositing amount to PF or CIT will get deduction of Rs 300,000 or 1/3rd or deposit amount whichever is lower.

- Female individual opting for single tax payer will get additional 10% tax exemption on tax liability.

- Insurance premium of self owned house by a resident natural person shall be allowed as expense up to premium amount or Rs 5,000, whichever is less

Impact on individual registered on SSF

- Person contributing in the Social Security Fund (SSF) shall be entitled to get exemption up to maximum of Rs. 500,000 instead of Rs. 300,000.

- No need to pay SST @ 1% if a person is contributing in the SSF.

Disclaimer: Sincere efforts have been made to avoid mistake or error or omission, however, there is always a scope of error so please check the formula for at least one person’s salary manually before use.