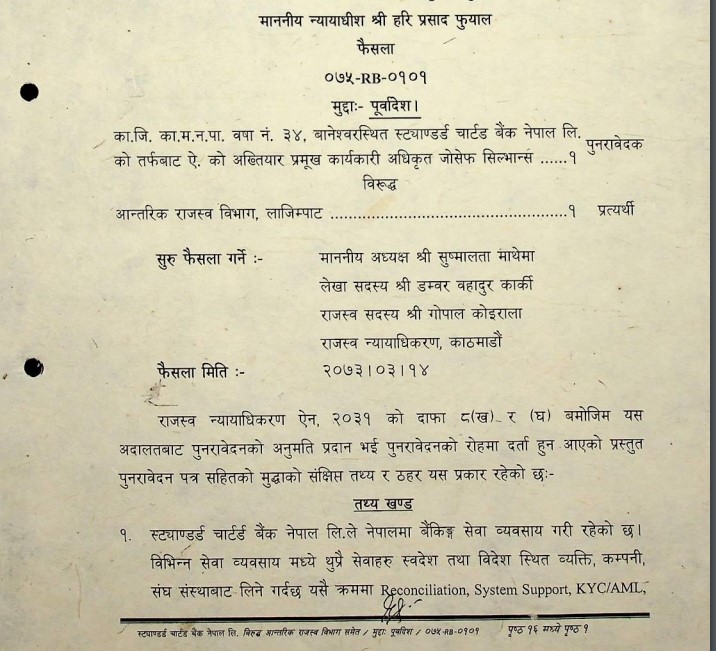

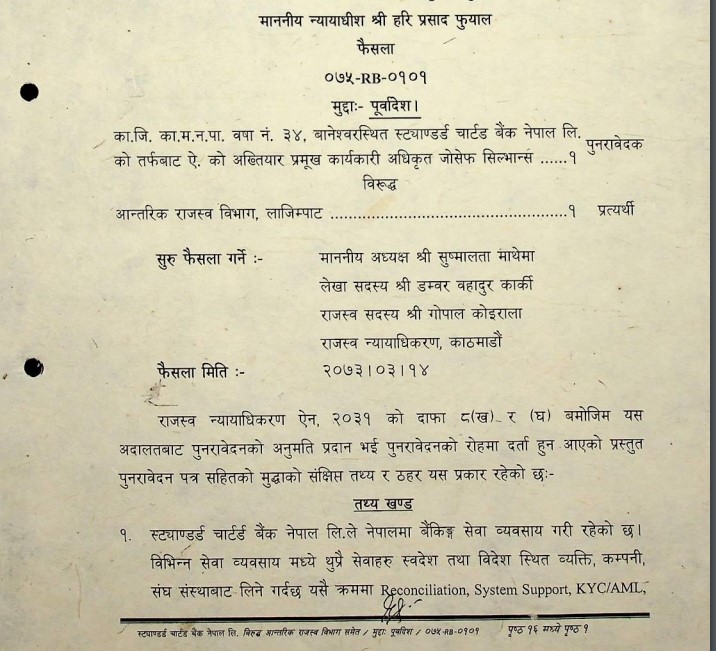

Supreme court case law on Standard Chartered Bank vs IRD Lazimpat

Case laws Standard Chartered Bank vs IRD Lazimpat ||TDS applicability on import of IT service (reconciliation, system support etc)

Case laws Standard Chartered Bank vs IRD Lazimpat ||TDS applicability on import of IT service (reconciliation, system support etc)

There are multiple section which provides for Interest, Fees & Penalty under the Income tax Act. Major provisions are outlined below: Section 117(1)(Ka) Failure to file Estimated Tax Return tax payable u/s 95(1):Higher of : (a) Rs. 5,000, or (b)…

Finance Act, 2079 has given considerable relief in Personal Income Tax. It has amended the tax slabs and also increased few deductions for the FY 2079/80 (2022/23) as compared to FY 2078/79 (2021-22). Excel Sheet for Salary TDS for FY…