According to the Finance Act of 2080-81, any individual earning an income above 50 lakhs will be subject to a tax rate of 39%, while the corporate tax rate stands at 25%. Additionally, companies are required to pay an extra 5% dividend tax when declaring dividends. To circumvent the additional 9% tax liability on proprietorship businesses, many businessmen are contemplating converting their existing businesses into private limited companies in Nepal. Here are the key process for the conversion of a proprietorship firm into a private limited company in Nepal:

Process of Conversion of Proprietorship Firm into Private limited company in Nepal.

- Ensure initial required capital in private limited is updated in Proprietorship Firm.

(Update your Banijya certificate if required) - Finalize cut off date, ensure proper calculation of compliance liability.

- We suggest you to withdraw profit till date or else have to transfer to pvt limited as director loan(considering tax paid profit).

- Registration of private company using same name, same ownership and same capital.

- Prepare minutes for transfers of all liabilities and assets to the company.

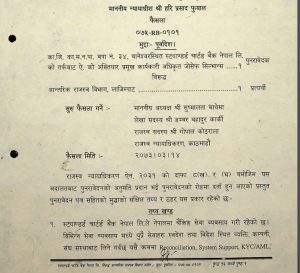

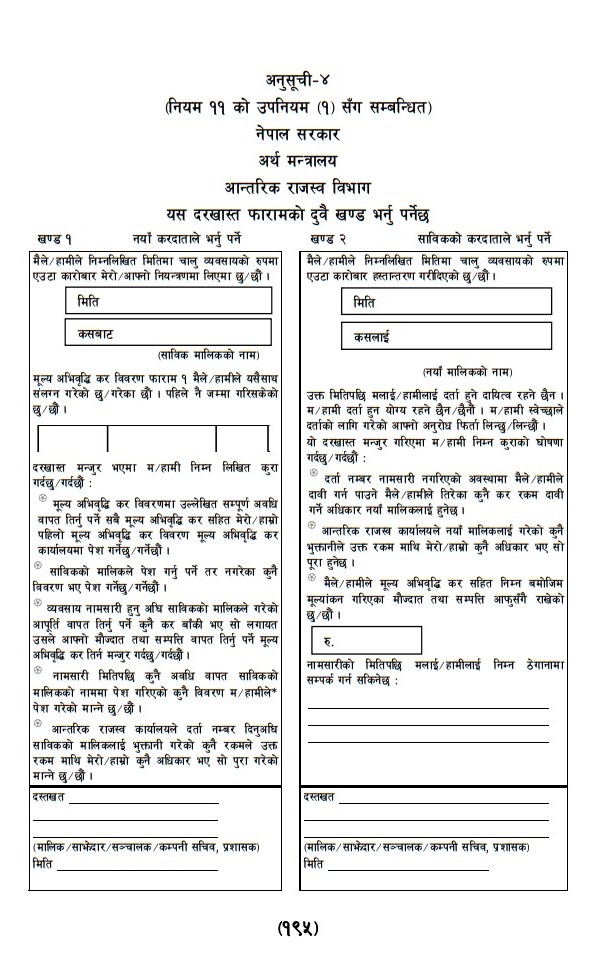

- Inform to tax office in Form 4 format of vat, regarding stock and other within 7 days of conversion.

- Transfer all the assets and liabilities to company.

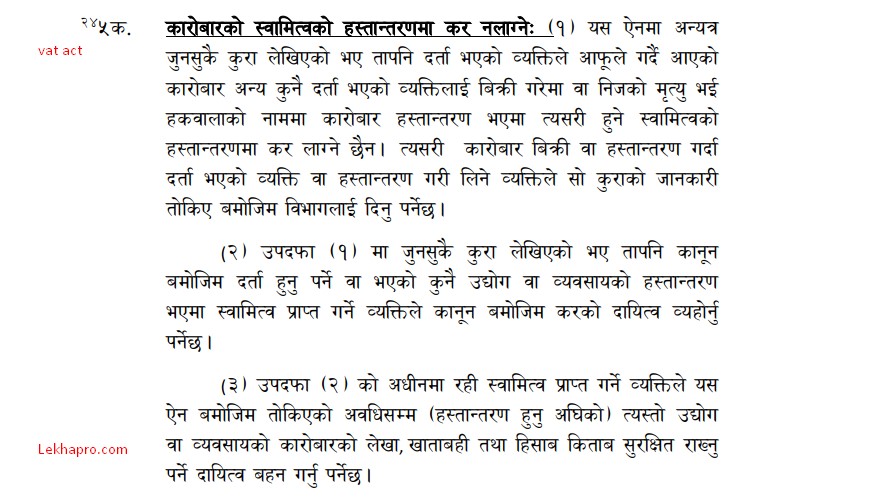

- As suggested in vat act vat will not be applicable in case of transfer of business.

Disclaimer: The information on this website is for general information purposes only. Sincere efforts have been made to avoid mistake, error or omission. We strongly advise our readers to seek advice from the expert before making any decisions.