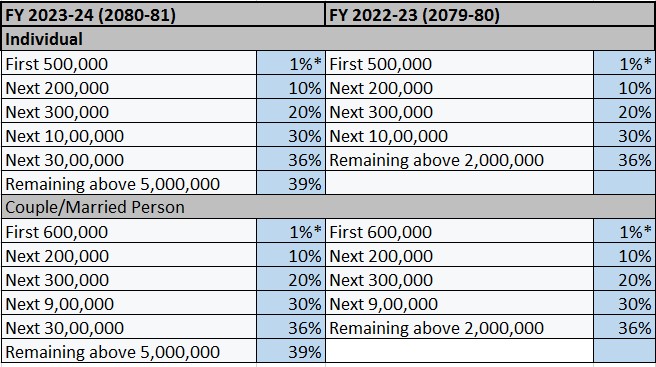

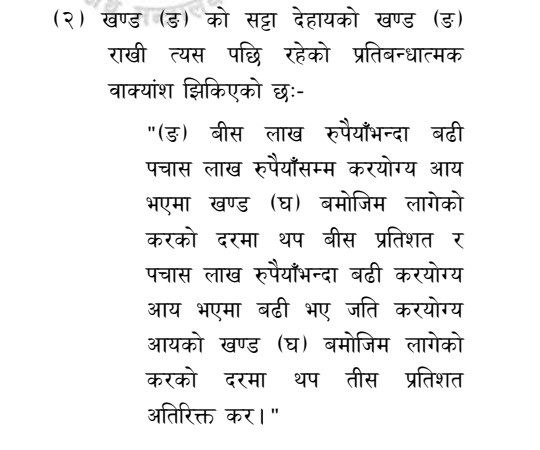

The Finance Act of 2080-81 introduced a single modification in the taxation brackets for individuals. Under this amendment, individuals with taxable income exceeding 5,000,000 will be subject to a tax rate of 39%.Accordingly excel sheet for salary TDS of 2080-81 is modified.

To check the TDS liability or calculate the annual TDS liability of your organization, you can download attached Excel sheet for salary TDS of 2080-81.

If you have determined the salary with the staff based on the net amount, utilize the following formula to calculate the gross salary.

1. Taxable amount nikalna PF deduction gareko milena jasto chha ho? Taxable amount is yearly chha but PF chai just 1 month ko deduct gareko chha.

2. 10% additional tax exemption for female ta single opt garyo vane matra paune haina ra? Couple garyo vane paudaina haina ra?

3. Monthly net salary payable pani nikalera dinuna.

Thanks

1.PF has to calculated on basic salary so you have to update manually.

2.Yes,As per normal practice so there is note”*if you want to choose Female (F) credit then choose single (S) as well” but there is a supreme court case laws which says otherwise.

3.Just customize the formula using “monthly salary -monthly TDS