The provisions relating to the Excise License and its fees is contained in the Section 8 to Section 10 of the Excise Act, 2058.

- Person liable to obtain Excise license

- Manufacturer, Importer, Seller or person storing excisable goods or providing excisable services to any person

- Physical control System Vs Self Control System:

- Physical Control System: Manufacturer of Liquor, Spirit, Khudo (molasses) and beer

- Self Controls System: Other persons such as Plastic Industries, Cement Industries, Soap & Detergent industries, Energy drink manufacturers etc.

- Application for obtaining the Excise License

- Copy of Application along with the license fee to the Excise Duty Officer in the prescribed format (Rule 3)

- On scrutiny of the application, if satisfied, shall issue the license in the specified format

- Validity of License

- License shall be valid until once fiscal year

- Renewal of License

- License shall be renewed within the month of Shrawan by paying the prescribed fees

- However, renewal for 3 fiscal year is permitted if renewal fees is paid at a time

- Excise Officer shall ensure before renewal that there is no excise duty payable and complied with the terms & conditions subject to which license was issued

- Renewal of License not required

- Licensee, other than tobacco related goods where Self removal system is applicable, shall not be required to renew the license as above

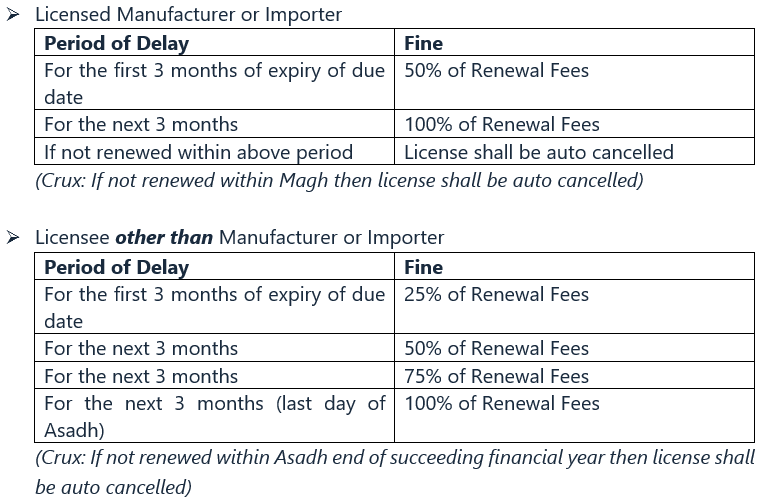

- Failure to renewal of License within the Time Limit

8. Other Important Points:

- If any person does transaction without obtaining the license, said person shall not be exempted from license fees and its renewal [Section -9(7)]

- If licensee has given application for Suspension of license, then such licensee is not required to renew the license for that suspended period [Section -9Ka(4)]

How to check excisable Item ?

In order to determine the applicability and amount of excise duty, the first step is to identify the relevant HSN (Harmonized System of Nomenclature) code for the product, followed by referring to the latest version of the Finance Act which contains information related to the excise duty applicable to the identified HSN code.

Disclaimer: The information on this website is for general information purposes only. Sincere efforts have been made to avoid mistake, error or omission. We strongly advise our readers to seek advice from the expert before making any decisions.