Registration of Private Limited company in Nepal is governed by section 3 of the Companies Act 2063 (2006). Registration of private limited company can be divided into three phases: Pre-registration, Registration and Post Registration.

Table of Contents

Pre-Registration

The first step for registration of private limited company is selection of suitable name and getting approval for the same from Company Registrar Office (CRO). Choosing an appropriate name is a very crucial first step as it affects the branding and perception of customers because it is the first thing that customers notice.

Steps for company registration

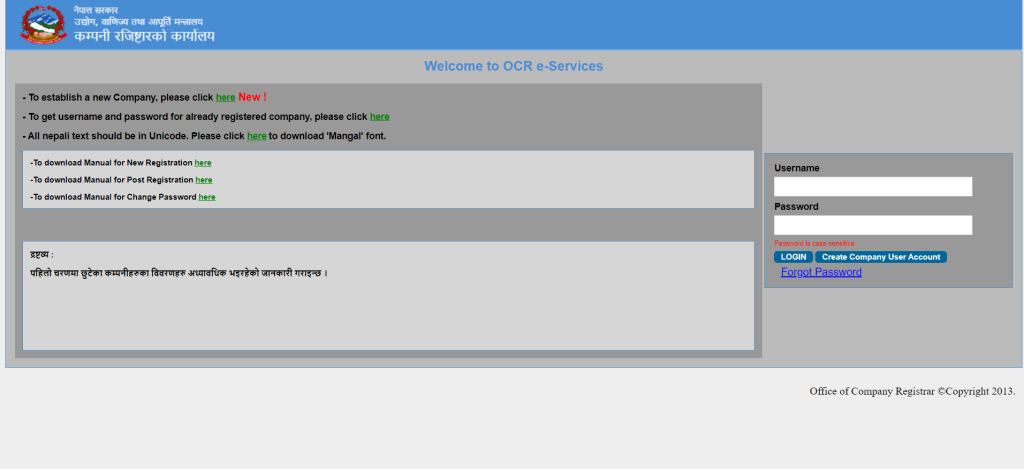

- Visit OCR Website and click on “Create a new user ID

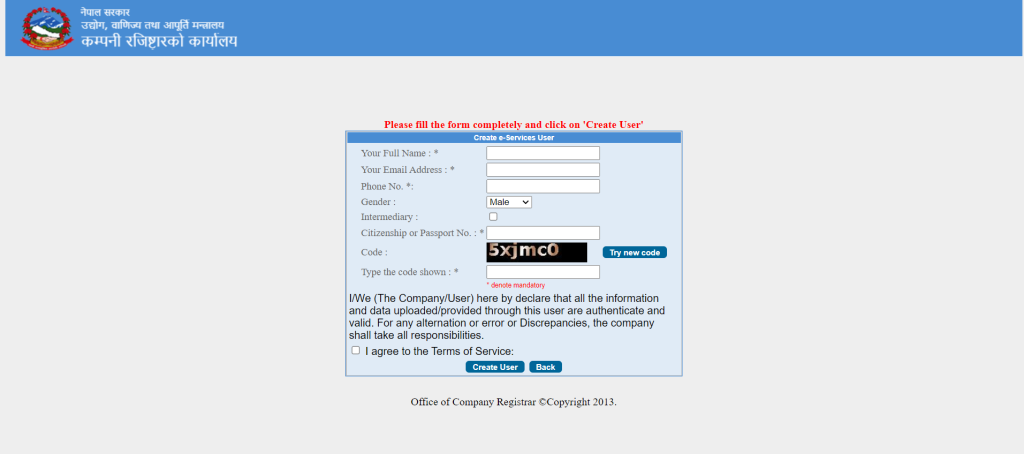

- Create a new user ID using full name, email address and phone number.

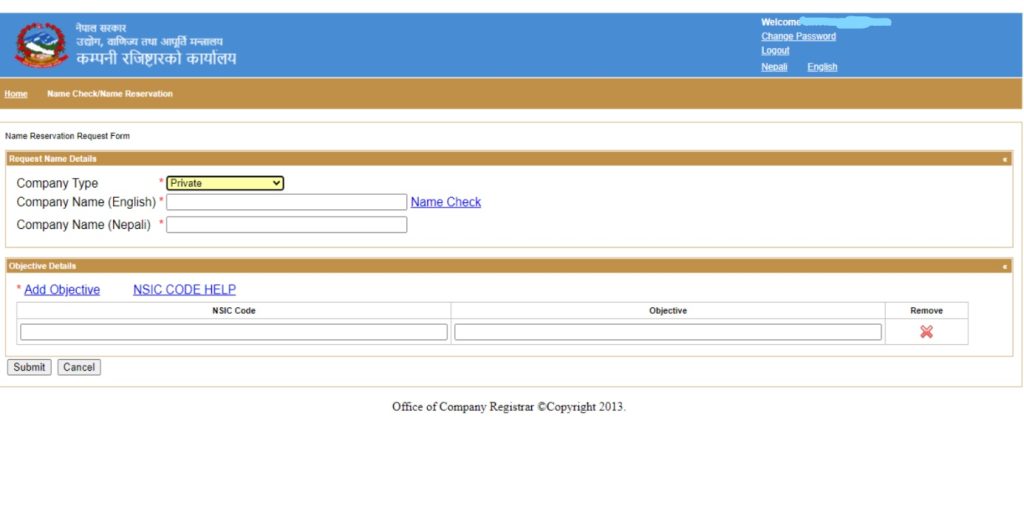

- Enter company type, name, objectives and check the availability of name.

Further Steps

- After submitting the application for name approval, you will receive an acknowledgement email from OCR.

- You can check the status of name approval by logging onto OCR e-services.

- Within 15 days, you shall receive an email from OCR regarding approval or rejection of the proposed name with reasons in case of rejection.

- If approved, the name will be reserved for 35 days within which you need to apply for registration of company along with relevant/prescribed documents.

- If rejected, you can request for a new name by following previous process.

There are multiple cases when names can be rejected in which case you have to follow the same process again for obtaining the approval of new name:

- The name of the proposed company is similar or identical with the name of an existing company.

- The name of the proposed company is not in line with the prevailing law or appears to be improper or undesirable in view of public interest, morality, etc.

- The name of the company is identical with the name of the company whose registration has been cancelled or has been declared insolvent under the prevailing law and period of 5 years have not elapsed.

Registration of the company:

- After name approval, login to OCR and fill out the details.

- Required Documents are to be attached while filling the form.

Further Steps

- After submitting the form online and all required documents, you will be able to download the application preview for future reference.

- Receive the temporary application ID, confirmation message and application details via email.

- Receive an email related to the approval or rejection of the proposed company registration.

- If not approved, submit the additional documents of information required, or do as instructed via email.

- Once the company registration is approved, visit the OCR with the application number, hard copy of all documents and prescribed fees.

- Receive the Certificate of Incorporation.

Other Registrations:

Ward Office Registration:

- Enter into a lease agreement showing your place of business and registered office.

- Deposit rental tax.

- Deposit business registration charge in name of concerned ward office.

- Get your business registered at the ward office.

VAT/PAN Registration:

Company is allotted PAN number by OCR itself at the time of registration of the company, however it is required to submit additional documents to Tax Office for obtaining VAT/PAN certificate:

- Apply for VAT/PAN online via IRD website or by physically visiting the concerned Inland Revenue Office.

- Compulsory registration where expected turnover is more than Rs. 50 lakh in case of goods and more than Rs. 20 lakh in case of services and Rs. 20 lakh for both goods & Services

- Voluntary Registration can also be done.

Opening of Bank Account

- A separate account must be created to open a bank account by submitting required documents in bank..

- The amount of share capital is ideally deposited into the bank account within a reasonable time period.

- All monetary transactions of the company are routed through the bank account.

Post Registration of the Company:

After registration of the company, it is required to give the intimation to the OCR (Office of the Company Registrar) for major events happening in the company within the prescribed timeline:

Initial Submission/Intimation to OCR

- Registered Office of the Company:

- The Registered office of a Nepalese company should be in Nepal as per the applicable rules under Companies Act.

- The company should provide details of the address where the company is established to the OCR within three months of registration of the company.

- Company’s office must also display a hoarding board outlining the name of the company and the registration number.

- Appointment of Auditor:

- The company shall also give the intimation to OCR regarding appointment of auditor within 15 days of appointment.

- Directors Register/Directors Lagat:

- After Directors take office, the details of the director should be provided to the OCR in the prescribed format.

- OCR shall approve the Directors Lagat (Sanchalak Lagat) and issue the signed copy.

- Shareholders Register/Share Lagat:

- Once the share capital has been issued and paid-up by a shareholder, the company should prepare a Shareholders Register and provide it to OCR within one month of collection of paid up amount.

- OCR shall approve the Share Lagat and issues the signed copy of the same.

As per Nepal Rastra Bank guidelines, if the paid up capital of the company is more than five lakhs then the share amount must be deposited into the Bank Account of the company and extract copy of the same is required for the approval of the share lagat.

Annual General Meeting (AGM)

- The company should conduct an annual general meeting (AGM) of shareholders within one year of establishment.

- After the first Annual General Meeting, it shall hold the AGM every year within six months after the expiry of its financial year.

- Section 76 along with its all sub sections shall be applicable to the private companies which have provided to conduct AGM in its Articles of Association

- Section 145 provides that “Except as otherwise provided in the Act, matters that if the AGM is not required to be held, provision pertaining thereto, may be provided for in a Consensus Agreement of Private Company.

Reporting and Compliance

- Books of Accounts of the company is required to be audited by an auditor every financial year.

- Appointment of the Auditor needs to be notified to OCR within 15 days of appointment.

- Annual audited accounts, auditor’s report, report on annual general meeting and the report about the number of shareholders of the company has to be filed within 6 months of the end of every financial year. A public limited company has to submit this within 30 days of annual general meeting.

- Reporting under Section 92 of the Companies for Directors

- Reporting under section 51 or 78 of the Companies Act to OCR as the case may be.

Disclaimer: The information on this website is for general informational purposes only. Sincere efforts have been made to avoid mistake, error or omission.